Exploring Coliving in the Netherlands: Key Statistics and Trends for 2024

It’s been only five years since Ian Schrager, one of the men behind the idea of “boutique hotels” suggested that coliving might be the future. In that short time, the coliving movement has definitely seemed to take off around the globe, including here in the Netherlands.

To get a better look at where this industry is headed, we’ll study the statistics for coliving in our country. The numbers we’ve collected should give us an idea of both coliving’s present and its future.

What are the Main Types of Coliving Services in the Netherlands?

Broadly speaking, all coliving services in the Netherlands may be sorted into one of two types. The key differentiator is the length of their target residents’ stays or residency periods:

- Longstay coliving spaces cater to people who wish to stay for at least 6 months.

- Shortstay coliving spaces cater to people who wish to stay for less than 6 months.

There are exceptions, of course. At The Social Hub (a shortstay coliving facility), for instance, international students are allowed to stay for the full academic year, which runs 10 months. Obviously, that goes far above the usual 6.

There are also a few differences in the facilities offered by companies based on the types:

- Longstay coliving facilities: chiefly private apartments (61%) and/or shared apartments (54%), with no private bedrooms for rent

- Shortstay coliving facilities: single apartments, with no shared apartments (rooms with shared amenities are offered instead)

These coliving statistics in the Netherlands make sense in light of local legislation currently covering private bedroom rental. Because prices for private bedrooms have more regulation, longstay providers avoid offering them and stick to shared apartments instead.

A shared apartment typically has multiple bedrooms. However, each apartment is nonetheless rented out on a single contract instead of individual contracts per bedroom, to get around the regulations on private bedrooms for rent.

Meanwhile, because shortstay rent prices aren’t regulated, about 15% of operators in this category are also offering rooms as budget shared living options.

What are the Target Demographics for Coliving Providers?

So, whom are coliving operators in the Netherlands targeting with their services?

In the main, shared living companies appear to be focused on the adult working population (aged 40 and below). Some also cater to students, specifically university-goers.

The target demographics for coliving in the Netherlands, 2024

No Data Found

This donut chart is in thousands of people living the coliving lifestyle. The total target demographic for coliving in The Netherlands is equal to 4,630,500 people.

Sources: students, working; 20-25 year olds, 25-30 year olds, 30-35 olds, 35-40 olds

The target demographics also appear to vary slightly between longstay and shortstay operators. For instance, longstay operators cater to single families while shortstay operators don’t.

To assess this, we looked at both types of coliving operators and their target markets. Note that these percentages are calculated based on operators’ target groups corrected for their total supply. So, smaller operators count for less than larger operators in the numbers.

Longstay Operators’ Target Demographics

All longstay operators target young professionals first, with expats and students being their second- and third-most-common demographic targets (80% and 71%, respectively).

Single families (49%) and digital nomads (45%) are targeted less. Nobody in this category currently targets seniors.

Shortstay Operators’ Target Demographics

Digital nomads are targeted by all operators in this category. Expats (99%) and young professionals (99%) are also targeted by nearly everyone. Interestingly enough, many operators also cater to students (94%).

By comparison, single-families and seniors are targeted by none of the shortstay operators.

What is the Current Coliving Supply in the Netherlands?

Current coliving supply in the country is high, with 11,621 operational beds across both longstay and shortstay providers, and another 8,789 in the pipeline (for longstay operators).

It’s worth noting that the numbers seem to favour longstay coliving heavily, at least going from supply. Not only do longstay operators have higher capacity overall but they also seem to be expanding faster, based on pipeline numbers.

Longstay Capacity by Beds

Loading..........

The Data is Not Available

Longstay coliving capacity in the Netherlands 2024

Shortstay Capacity by Beds

Loading..........

The Data is Not Available

Shortstay coliving capacity in the Netherlands 2024

Who are the Largest Coliving Operators in The Netherlands?

The two biggest longstay coliving providers in the Netherlands are OurDomain and The Cohesion. In the shortstay space, however, the top player is The Social Hub followed by Zoku.

What Services do Coliving Contracts Include in the Netherlands?

Coliving providers in the Netherlands often differ in their service inclusions based on the type of coliving they provide. This is often due to the difference in long-term and short term service operating costs and logistics.

Longstay Coliving Services

One major difference between longstay and shortstay coliving contracts is that most longstay providers don’t offer all-inclusive utility contracts.

To be precise, only 26% of longstay coliving options are offered with such contracts. Most operators (72%) only include specific services such as heating and/or warm water – and then only because it’s mandatory due to the building being connected to district or block heating.

That said, most coliving units do include WiFi in longstay facilities (98%). Furniture is always offered, but not always included. As for cleaning, it’s rarely offered, with only 4% of contracts being offered with it.

Shortstay Coliving Service Contracts

Unsurprisingly, shortstay coliving supply is always offered with all-inclusive utility contracts, WiFi, and even furniture.

Cleaning is also included in only 6% of short stay contracts, which makes it very slightly more common than in longstay contracts. It’s worth noting that these are usually the operators that focus more on travellers, so clients will often stay only a couple of nights.

How Accessible are the Coliving Facility Locations in the Netherlands?

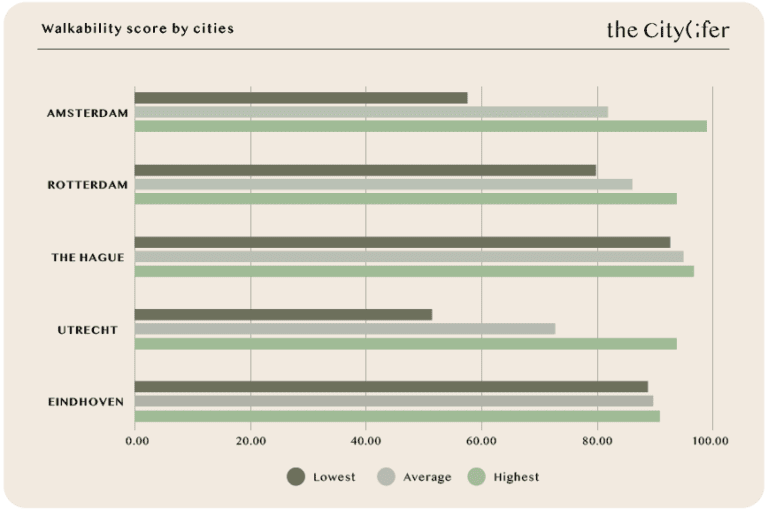

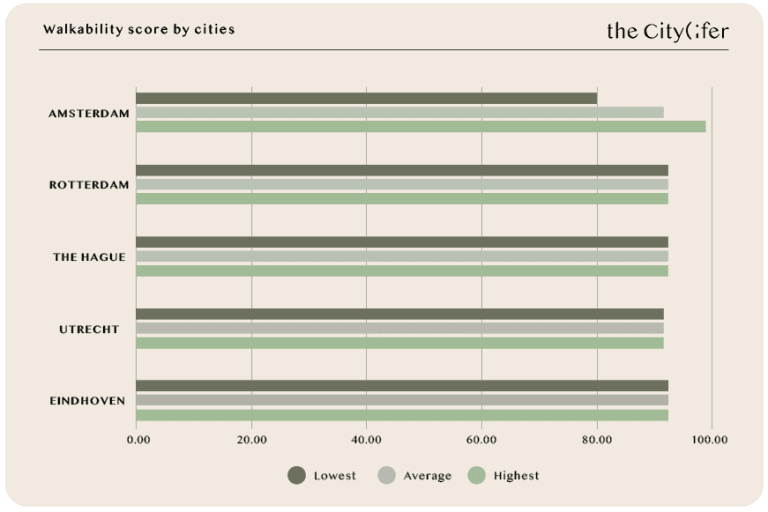

To look at this, we studied the coliving facilities in the country’s 5 largest cities. Facility accessibility was assessed in terms of each area’s walkability, which is a measure of how easy it is for a person in that location to safely walk to core services and amenities.

In this area, the delta between the least and most walkable spots was bigger for longstay coliving operators. The lowest walkability scores for their category were between 50 and 60 (specifically, for some Amsterdam and Utrecht providers). By comparison, the lowest walkability score for shortstay operators was 80 (also in Amsterdam).

That said, in all save one city (Eindhoven), the highest walkability scores were also from longstay coliving operators.

Longstay Walkability Score in Cities in the Netherlands

Longstay coliving facility accessibility in the Netherlands 2024

Shortstay Walkability Score in Cities in the Netherlands

Shortstay coliving facility accessibility in the Netherlands 2024

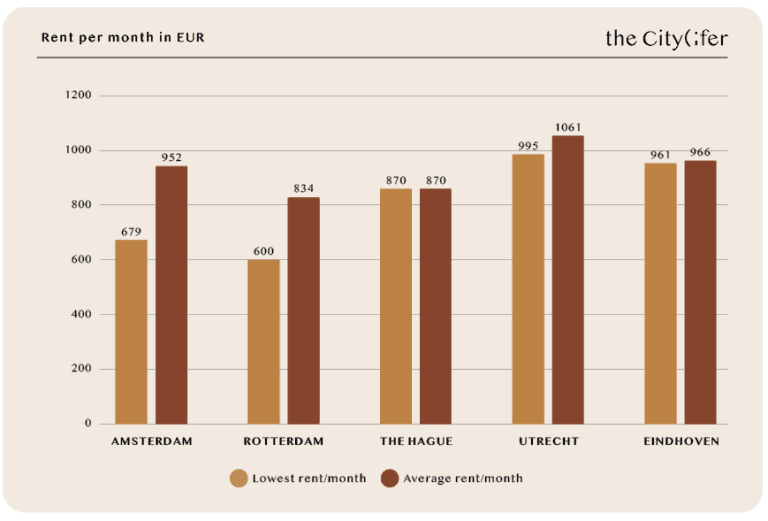

What are the Prices or Rates for Coliving Services in the Netherlands?

Rates for coliving spaces in the Netherlands vary, with longstay generally costing less per unit of time but also including fewer services.

In the cities we evaluated, the lowest starting price was €600 per month for a Rotterdam coliving operator, with the city average being around €834. Rotterdam also has the lowest average for all five cities, while Utrecht has both the highest lowest starting price (€995) and average (€1,061).

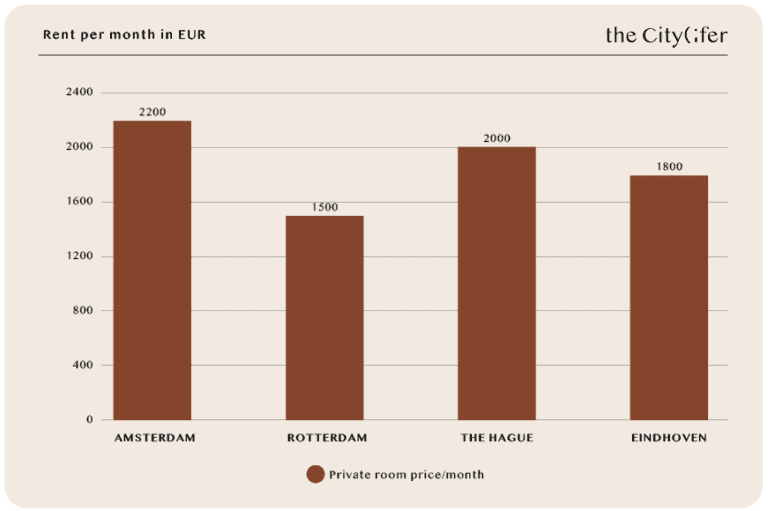

When expanding the survey to shortstay coliving operators, we see coliving appear to be less of an affordable housing option, especially when converting shortstay rates into the same unit of time as longstay ones. At nightly tariffs of €125 to €175 in Amsterdam, for instance, shortstay coliving prices come out to around €3,750 to €5,000 per month!

Of course, the coliving option selected will also affect rates. Shortstay coliving spaces start from €1,100, as an example, whereas for private apartments, you may pay €1,500 in Rotterdam, €1,800 in Eindhoven, €2,000 in The Hague, and €2,200 in Amsterdam.

Longstay Coliving Rates in Key Dutch Cities 2024

Longstay coliving rates in key Dutch cities 2024

Shortstay Coliving Rates in Key Dutch Cities 2024

Shortstay coliving rates in key Dutch cities, 2024

What are the Most Popular Coliving Communal Spaces in the Netherlands?

The most popular coliving communal spaces in the Netherlands are the outdoor spaces for longstay coliving residents (91.74%) and study or co working spaces, event & activity spaces, and living room/kitchen spaces (99.05%) for shortstay coliving residents.

The difference in coliving space preferences, especially in the “outdoor spaces” category, may be due to a number of things. Chief among them, however, could be the fact that shortstay operators just tend to offer limited outdoor spaces.

Despite that, they also offer slightly more amenities than longstay operators.

Longstay Most Popular Coliving Communal Spaces in the Netherlands, 2024

No Data Found

Most popular communal spaces in longstay coliving spaces in the Netherlands, 2024

Shortstay Most Popular Coliving Communal Spaces in the Netherlands, 2024

No Data Found

Most popular communal spaces in shortstay coliving spaces in the Netherlands, 2024

What are the Most Popular Coliving Community Events in the Netherlands?

For these coliving statistics, we broke down coliving community-building activities into the following categories:

- Social: Gatherings focused on interpersonal connections, like parties or mixers.

- Sports/Health: Events related to physical activities, sports competitions, or health awareness.

- Education: Academic or learning-focused events, like seminars, workshops, or lectures.

- Cultural: Events like theater, exhibitions, and musical performances.

- Volunteering: Activities where participants offer services or support for free, to the community’s benefit.

The data showed that both longstay and shortstay coliving residents favoured Social events (94.83% for longstay, 100% for shortstay) above all, with Sports/Health events (93.78% longstay, 93.99% shortstay) coming a close second.

However, while longstay residents were still moderately interested in Education (52.04%) and Cultural events (47.10%), shortstay ones were barely interested in both (6.01% and 5.06%, respectively).

Furthermore, Volunteering events only got 10.47% of the vote from longstay residents but 0% from shortstay ones.

Longstay Most Popular Coliving Community Activities in the Netherlands, 2024

No Data Found

Most popular community activities in longstay coliving spaces in the Netherlands, 2024

Shortstay Most Popular Coliving Community Activities in the Netherlands, 2024

No Data Found

Most popular community activities in shortstay coliving spaces in the Netherlands, 2024

How High or Low is Customer Satisfaction for Coliving in the Netherlands?

Finally, we come to one of the most important coliving statistics. How high or low is customer satisfaction for current providers? This figure matters because it may well indicate whether or not there’s still space for more providers to enter the industry or for current ones to evolve.

For this, we took Google ratings as a measure of customer satisfaction. Once again, the numbers varied from longstay to shortstay coliving providers.

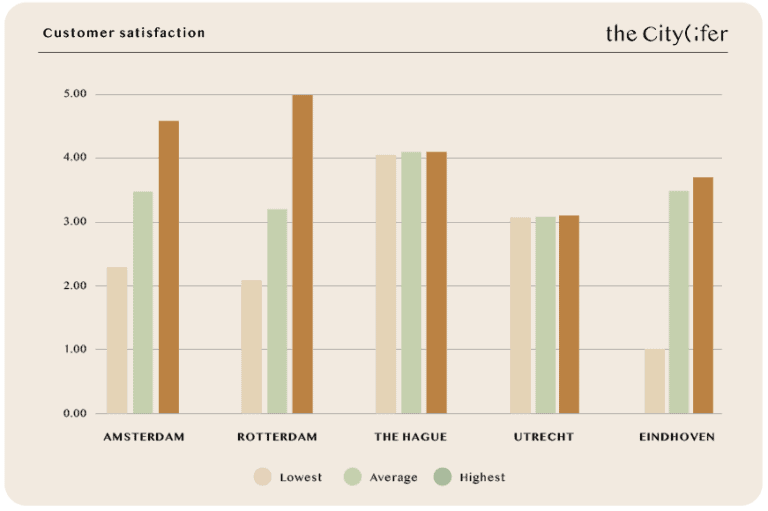

Customer Satisfaction for Longstay Coliving Operators

Once again, the longstay coliving category got more variance between its highest and lowest ratings. Rotterdam’s lowest Google rating was 2.1, for instance, while its highest was 5.0.

Overall, more longstay operators got lower scores than shortstay ones, with several even posting scores of 3.1 and below. This tells us that longstay operators may soon begin studying shortstay coliving operators’ systems as models. They may even emulate or adapt parts of them to better serve their own customers.

Customer satisfaction for longstay coliving services in the Netherlands 2024

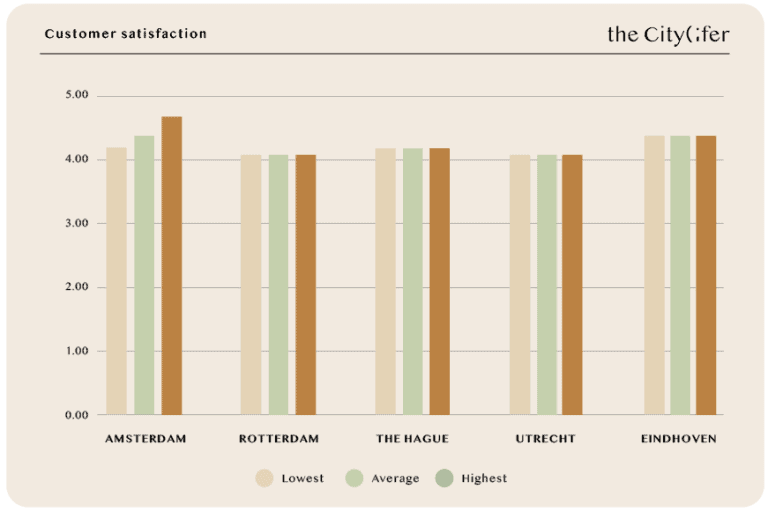

Customer Satisfaction for Shortstay Coliving Operators

As we said above, it appears as though shortstay operators may score a little more consistently in this area. The biggest delta between the highest and lowest score here was for shortstay providers in Amsterdam (4.2 vs 4.7).

Furthermore, the category’s lowest score was 4.1, which is clearly far above several longstay operators’ lowest scores. It’s uncertain whether or not shortstay operators can keep it up, however, especially as growing demand for their services may tempt them into scaling operations in ways that change current service models.

Customer satisfaction for shortstay coliving services in the Netherlands 2024

Coliving in 2024 and beyond

From the data, we can see that coliving’s popularity grew in 2023 and appears to be on an upward trajectory for 2024. Longstay coliving, in particular, seems poised to take off as one of the main accommodation options for different demographics in the country now.

While those demographics haven’t seemed to change too much over the past year, it’s perfectly reasonable to expect operators to begin diversifying soon. Furthermore, as the industry grows and demand rises, it’s possible to predict higher competition in the space. This may well become a boon for consumers by keeping rates competitive and encouraging operators to improve services.

Whatever else the year may hold for coliving, we at The Citylifer are looking forward to noting and even being part of the industry’s next developments. For us, this is just the beginning!

FAQ

The types of coliving services in the Netherlands include longstay and shortstay coliving options for people such as young professionals, expatriates, and students. Single-family and digital-nomad coliving facilities are also available.

Coliving costs in the Netherlands are highly variable and dependent on the type of coliving facility and services you select. However, they can be as low as €600 per month for longstay options and as high as €5,000 per month for shortstay ones.

The main hubs for coliving in the Netherlands are Amsterdam, Rotterdam, The Hague, Utrecht, and Eindhoven.

Rules and regulations vary based on the coliving facility you choose, but you may expect general tenancy laws to apply. For example, you and your landlord or coliving facility operator cannot spontaneously break the terms of the contract you agreed to, or alter those terms unilaterally.