There is a lot to figure out when moving to a new country. Finding a place to live, adjusting to a new culture, and of course, sorting out your health insurance.

In the Netherlands, having health insurance (zorgverzekering) isn’t just important; it’s mandatory. Failing to get coverage can lead to fines, and with so many options available, choosing the right plan can feel overwhelming.

While keeping healthcare ties back home may seem convenient, it’s often impractical. You may lose patient status with providers abroad, and travelling for treatment can be costly, especially in emergencies. Securing the right health insurance in the Netherlands ensures you get the care you need when you need it.

The good news? The Dutch healthcare system is one of the best in the world, and this guide will help you navigate it with ease.

Here’s what you’ll learn:

How the Dutch healthcare system works

The best and most affordable health insurance options

How to compare plans and choose the right provider

How to apply for healthcare benefits (zorgtoeslag)

How to switch providers or cancel your insurance

Whether you’re an expat, student or long-term resident, this guide will give you everything you need to make decisions about your healthcare in the Netherlands.

Overview of the Dutch Healthcare System

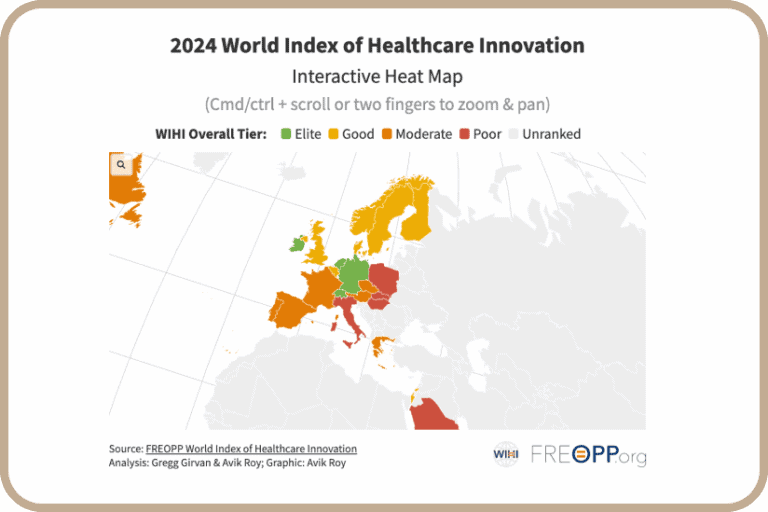

The 2024 World Index of Healthcare Innovation assessed the Dutch healthcare system. It stands in 4th place with a score of 57.82—Switzerland has 1st place with 66.19, Ireland has 2nd with 59.52, and Germany has 3rd with 58.54.

The achievement stems from a powerful national healthcare system. This system has a reputation for availability, high standards along with attention to patients. The nation applies a managed rivalry structure, where private companies offer required health insurance. The government maintains cost levels through financial assistance plus controls.

The Netherlands healthcare model has both government also individual organizations.

Because it runs through taxes, social security as well as health plans from firms that want to profit, funding becomes available—these companies also provide extra programs so that people can use personal medical options.

Who is Required To Have Health Insurance in the Netherlands?

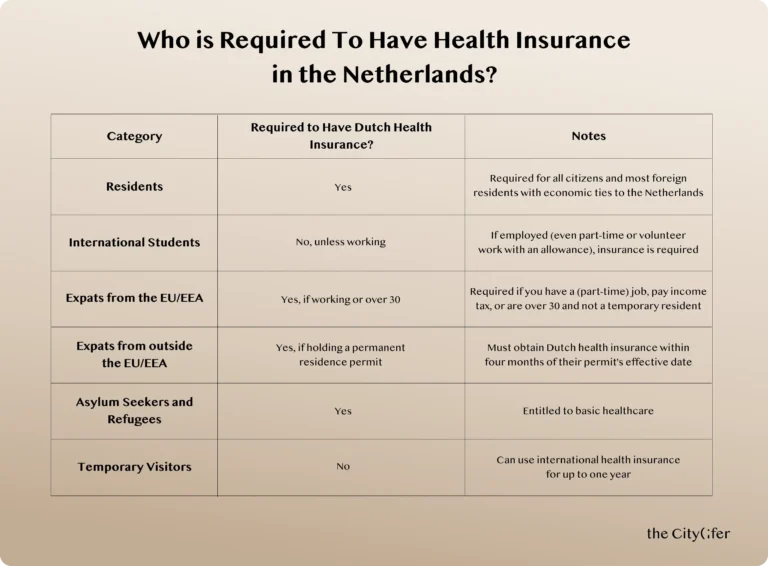

Everyone who lives or works in the nation is required to have at least basic health insurance (basisverzekering) under the Healthcare Insurance Act (Zorgverzekeringswet, Zvw). This guarantees access to basic medical services like doctor visits, hospital stays, and prescription drugs.

However, not everyone falls under this requirement. Some individuals are exempt, while others must adhere to different rules based on their residency or employment status.

Who Should Have Health Insurance?

Let’s break down who exactly this applies to:

Residents

Dutch law mandates health insurance for all citizens. Most foreign residents and their families must also have health insurance, provided they have established sustainable (economic) ties to the Netherlands (i.e., ingezetenschap).

You establish ties to the Netherlands if you reside there for more than three months and meet one of the following criteria:

You are a tax resident.

You are regularly employed (or self-employed) in the Netherlands.

You volunteer for a Dutch organisation.

You have close family in the Netherlands.

Your children attend a Dutch school.

You are enrolled in a Dutch-language, integration, or vocational course at a Dutch institution.

However, some exceptions exist. Those with residence permits for study, working holidays, or cultural exchange are not required to have Dutch health insurance and may use their existing foreign coverage. Expatriates without established ties to the Netherlands or its economy (niet-ingezetenen) can use international health insurance for up to one year.

International Students

Foreign pupils often do not qualify for Dutch health plans—they must keep their current protection from their own nations. But if a scholar starts at a local job while still in school—such as working limited hours, performing paid duties for gaining experience or aiding others besides getting funds—the Wlz plan (Long-term Care Act) perhaps covers them. The person needs Dutch health insurance. Even those with a ‘zero-hour contract’ must follow this rule.

Expats from the EU/EEA

If you are from the European Union (EU) or European Economic Area (EEA), you are required to obtain Dutch health insurance if:

You have a (part-time) job and/or pay income tax in the Netherlands

orYou are 30 years or older and your stay in the Netherlands is not temporary.

Family members may also need to get Dutch health insurance. If you don’t meet these requirements, you likely aren’t eligible for Dutch health insurance, but you can consider private expat insurance for healthcare coverage in the Netherlands.

Expats from Outside the EU/EEA

Non-EU/EEA expats are eligible for Dutch health insurance if they have a permanent Dutch residence permit. They must obtain this insurance within four months of the permit’s effective date.

However, you are not eligible for Dutch health insurance if you are in the Netherlands:

Solely for study purposes

Working for an employer based outside the Netherlands

Paying income tax in another country

If you don’t qualify for Dutch health insurance, expat health insurance is an option.

Asylum Seekers and Refugees

In the Netherlands, asylum seekers and refugees are automatically entitled to basic healthcare. Most reception centres provide on-site healthcare facilities.

What Does Basic Health Insurance Cover?

The government evaluates the mandatory health insurance package annually. However, it provides comprehensive coverage and typically includes the following benefits:

Hospital admission and care

General practitioner (GP) consultations and treatments

Limited coverage for medical aids and medications

Treatments and surgeries by medical specialists

Psychological care (GP and specialist treatment with a referral)

Emergency medical care abroad (at Dutch rates)

Limited maternity care

Physiotherapy (only for chronic conditions)

Speech-language therapy

Occupational therapy

Ambulance transport

Dietary and nutritional advice

Dental care for children under 18

You can enhance your basic health insurance coverage with supplemental plans that cover services such as:

Physiotherapy

Medical treatment abroad (for costs exceeding those covered by Dutch health insurance)

Orthodontic care

Alternative therapies

Eyeglasses and contact lenses

Dental care

Contraception

Vaccinations

However, insurers have the right to decline applications for additional insurance. They may also require health information before approving coverage.

How to Get Health Insurance in the Netherland

Here is a step-by-step guide to getting health insurance in the Netherlands:

Step 1: Prepare For Dutch Healthcare

If you’re planning to move to the Netherlands, your first step is to ensure you have the right health coverage even before your arrival.

If you’re from the EU/EFTA/UK: Check if your EHIC (European Health Insurance Card) or GHIC (Global Health Insurance Card) covers temporary healthcare in the Netherlands. You may also need to complete an S1 form through your current health insurer to continue accessing healthcare abroad.

If you’re from a non-EU/EFTA/UK country: You will need to purchase private health insurance as part of your Dutch visa application. This is required to qualify for residence and access medical services upon arrival.

Step 2: Register with the Municipality and Get a BSN Number

Before you can apply for health insurance, you must register with your local municipality (gemeente) and obtain a BSN (Burgerservicenummer), a personal citizen service number.

Here’s how you can get a BSN:

Book an appointment at your local gemeente office. Some municipalities require a pre-scheduled appointment for registration, which can take several weeks and delay the issuance of your BSN number. To avoid any setbacks, we recommend booking an appointment as soon as you arrive.

Bring the required documents. This includes your passport and a registered home address. Non-EU citizens must also present a residence permit and, if applicable, an employment contract.

Receive your BSN number within a few days after registration.

Once you have completed this step, you can choose any insurance provider. By law, insurers cannot deny your application, even if you have pre-existing conditions.

Step 3: Compare Health Insurance Providers

The Netherlands has a regulated health insurance market, meaning all insurers must provide the same basic coverage, but they can set different:

Monthly premiums (ranging from €130–€160 per month)

Service quality (customer support, claims processing)

Preferred healthcare providers (some plans cover only contracted hospitals/doctors)

Make sure that you use independent comparison websites like zorgwijzer.nl.

Step 4: Choose Your Health Insurance Plan

Once you’ve compared providers, select a plan based on:

Premium Costs: Premiums vary depending on the insurer and level of coverage. Compare different providers to find a plan that balances affordability with your healthcare needs. Cheaper plans may have restrictions on healthcare providers or higher out-of-pocket costs.

Deductible Amount (Eigen Risico): The mandatory deductible is €385, but you can voluntarily increase this amount (up to €885) to lower your monthly premium. If you rarely visit a doctor, opting for a higher deductible could save you money. If you have frequent medical needs, a lower deductible is better.

Coverage Scope: Assess the range of services included, such as dental care, physiotherapy and mental health support.

Choice of Healthcare Providers: Some insurance providers restrict your choice of doctors, hospitals and specialists. If you want the flexibility to choose most healthcare providers, look for a plan that offers a combination policy (combinatiepolis). Some healthcare services are covered directly (natura), while others are reimbursed.

However, if you choose a non-contracted healthcare provider, you will only receive partial reimbursement for the bill.

English-Speaking Customer Support: For non-Dutch speakers, look for English-speaking customer support. Some insurers provide full English language services, digital portals and policy documents, while others may have limited support. Expats should check if their chosen insurer offers English-language assistance for claims, customer service and healthcare navigation.

Step 5: Apply for Health Insurance

Once you’ve selected a provider and plan, you can apply online via the insurer’s website. You need to present these documents for application:

BSN (citizen service number)

Proof of Dutch residence or work contract

Bank account details (IBAN) for direct debit payments

Approval is usually instant or within a few days. Once approved, you’ll receive your insurance card (zorgpas) and policy details.

Comparing Health Insurance Plans: Best & Cheapest Options

Choosing the right health insurance in the Netherlands depends on your specific needs, budget, and whether you prioritise comprehensive coverage, affordability or expat-friendly services.

Below, we compare the best and cheapest Dutch health insurance providers.

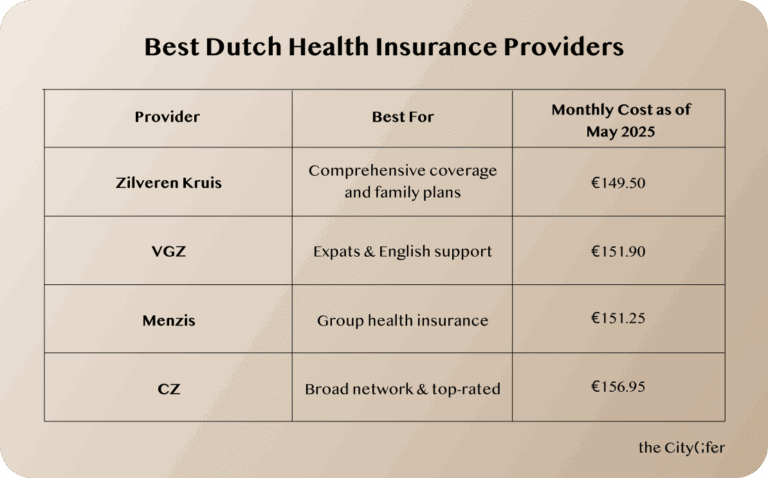

Best Dutch Health Insurance Providers

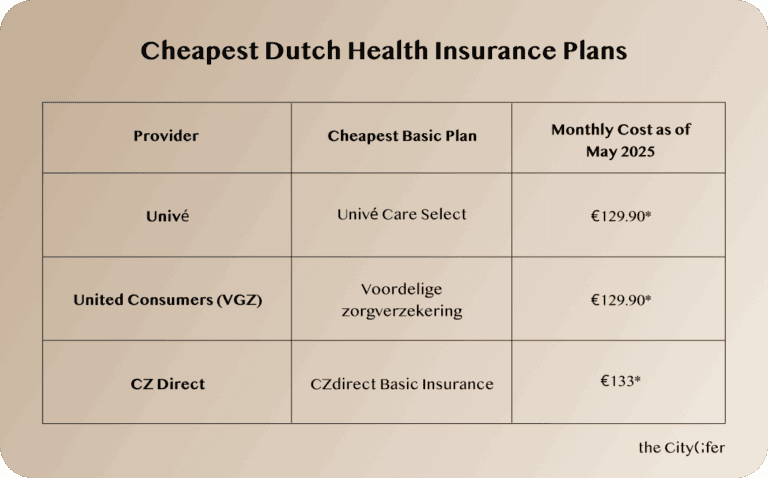

Cheapest Dutch Health Insurance Plans

*These premiums are based on a higher eigen risico (€885 deductible), which lowers your monthly costs but increases out-of-pocket expenses when using healthcare services.

Our Verdict

Given our study of different providers based on coverage, affordability and suitability for different groups, this is what we found:

Best Overall Coverage: Zilveren Kruis

Zilveren Kruis offers one of the most comprehensive health insurance plans in the Netherlands. It provides extensive hospital and specialist coverage, generous reimbursement policies, personalised care assistance, and excellent family-oriented plans.

And during emergencies, the provider also fully reimburses you at any hospital, no matter your basic insurance.

The most comprehensive package—Basis Exclusief—lets you pick any hospital you want, with reimbursement reaching up to 100% of the current market rate. Most care providers will get reimbursed at that full rate, but just a heads up: non-contracted mental health care and district nursing are reimbursed at 85% of the average contracted rate. If you go with a contracted provider, you can enjoy complete coverage.

Additionally, it has useful extras such as flexible payments, the Zilveren Kruis app, and waiting list mediation.

Best for Expats: VGZ

VGZ stands out for its expat-friendly services, including English-language support and streamlined digital processes. Expats who are unfamiliar with the Dutch healthcare system can benefit from the clear communication, easy claims process, and extensive partnerships with healthcare providers.

While the premium is slightly higher than budget providers, the added convenience and customer service make it worth considering.

Its online platform and mobile app offer English support, making it easier for expats to navigate policy details, submit claims, and find doctors who accept their insurance. You can also check wait times through the app. This allows you to choose the most suitable and immediate care for your needs.

Best for Group Health Insurance: Menzis

If you are looking for group health insurance, Menzis is your best bet. It is a great choice for businesses, organisations and associations looking to insure their employees or members.

Group health plans often come with lower premiums, added benefits, and wellness programs to support employees’ overall health.

Opting for Menzis group health insurance through your employer not only provides a discount on supplementary (dental) insurance but also grants access to additional perks that support a healthier lifestyle, including:

Discounts on eyewear or a bicycle

A personal health assessment

Consultations with a mental coach, budget coach, or menopause consultant

A sleep analysis, and more

As a group member, you also get a discount on the premium for additional (dental) insurance.

Best Budget Option: Univé and United Consumers

For those looking to minimise their monthly premium, Univé and United Consumers offer the most affordable basic plans. These plans come with a higher eigen risico (€885 deductible), which means lower monthly costs but higher out-of-pocket expenses when using healthcare services.

This makes them ideal for healthy individuals who do not anticipate needing frequent medical care but want coverage for emergencies.

Understanding Health Insurance Costs

It can get easily overwhelming when you’re trying to understand the Dutch health insurance system, especially with the costs involved. We’ll break down the key components of health insurance expenses in the Netherlands, giving you a clearer picture of what to expect.

How Much is Dutch Health Insurance Per Month?

The cost of health insurance in the Netherlands consists of two main parts: the basic premium and any additional coverage.

Basic Premium

The average cost for a basic health insurance plan is €158.72 per month.

This covers standard healthcare services, including visits to general practitioners (GPs), hospital stays, emergency care and prescribed medications.

Every insurer offers a similar basic package, as required by law, but monthly premiums can vary.

Additional Coverage (Aanvullende verzekering)

If you require extra coverage beyond the basic plan, such as dental care, physiotherapy, alternative medicine or extended mental health support, you can opt for supplementary insurance.

The cost of additional coverage ranges from €10 to €50 per month, depending on the provider and the services included.

Unlike the basic plan, insurers are not obligated to accept all applicants for supplementary insurance.

How Much is Dutch Health Insurance Per Month?

The cost of health insurance in the Netherlands consists of two main parts: the basic premium and any additional coverage.

Eigen Risico (Deductible): How Does it Work?

Sometimes referred to as ‘own risk’, eigen risico is the amount you must pay out-of-pocket for healthcare costs before your insurance provider starts covering expenses.

The standard eigen risico is €385 per year. This means that you are responsible for paying the first €385 of your medical expenses each year. Once you’ve reached this threshold, your insurance will cover the remaining costs for covered services.

You have the option to choose a higher eigen risico, up to a maximum of €885. Opting for a higher deductible can significantly lower your monthly premiums. This can be a good strategy for individuals who are generally healthy and don’t anticipate needing frequent medical care.

However, you should carefully consider your financial situation and potential healthcare needs before opting for a higher deductible. If you do require frequent medical care, a higher deductible could result in bigger out-of-pocket expenses.

When does your health insurance deductible apply?

You’ll need to pay your deductible (eigen risico) only when you incur costs covered by your basic health insurance. This includes expenses like:

Hospital treatments, checkups and specialist visits

Prescription blood tests and other lab work

Prescription medications

Emergency medical care and transportation

Mental healthcare from a psychologist, psychiatrist or mental health clinic

When is the deductible not required?

You won’t have to pay the deductible for certain medical expenses, such as:

Consultations and treatments from your family doctor (GP) or within their practice

Emergency treatments at the GP out-of-hours service

District nursing care

Obstetric and maternity care

Specific medical aids

Healthcare covered by your supplemental insurance package

Dutch Healthcare Benefits and Zorgtoeslag

The Dutch healthcare system ensures that all residents have access to high-quality medical care. However, health insurance costs can be a financial burden, especially for those with lower incomes.

To help with this, the Dutch government provides a healthcare allowance called Zorgtoeslag.

What is Zorgtoeslag?

Zorgtoeslag is a healthcare allowance from the Dutch government that helps lower-income residents pay for their mandatory health insurance. The amount you receive depends on your income, household situation, and other factors, with more support given to those who earn less. This ensures healthcare stays affordable for those who need it most.

Who is Eligible for Zorgtoeslag?

To qualify for the Dutch healthcare allowance, you (and your fiscal partner) must meet these conditions:

You are at least 18 years old.

You have Dutch health insurance.

You hold an EU nationality, a valid residence permit or a work permit.

Your income is below the specified threshold.

Your assets do not exceed the allowed limit.

Income Requirements for Zorgtoeslag

For most expats, eligibility for healthcare allowance depends on income. The Dutch tax authorities differentiate between single individuals and those with a fiscal partner:

No fiscal partner: Your gross annual income must not exceed €39,719 (2025).

With fiscal partner: Your combined annual income must not exceed €50,206 (2025).

Additionally, asset limits apply. In 2025, the maximum allowable assets are €141,896 for individuals and €179,429 for partners combined.

How Much Allowance Can You Receive?

The amount of zorgtoeslag you receive depends on your income—the higher your salary, the lower the allowance.

To check if you’re eligible for monthly support, visit the Dutch tax office’s healthcare allowance page. You can also use the Belastingdienst trial calculation tool to estimate your allowance based on your personal details.

How to Apply for Zorgtoeslag

Applying for Zorgtoeslag is a simple process that can be done online through the Dutch tax authority (Belastingdienst). Follow these steps:

1. Log In To MijnToeslagen.nl

Visit the official website of the Belastingdienst (Dutch Tax Authority).

Log in using your DigiD (a secure digital identification system for Dutch residents).

2. Enter Your Personal and Financial Details

Provide your income details from employment, benefits, or other sources.

If applicable, include your partner’s financial details.

3. Submit Your Application

Review your information and submit your request.

The Belastingdienst will assess your eligibility based on your provided details.

4. Receive Monthly Payments (if approved)

If your application is successful, the allowance is deposited monthly into your bank account.

The payment amount depends on your income level and household situation.

Switching or Cancelling Health Insurance

Fortunately, you have the flexibility to switch providers if you find a better plan. However, there are specific rules and deadlines you must follow to ensure a smooth transition.

How to Switch Health Insurance Providers

You can only switch your health insurance policy or provider during a designated period each year, which lasts about 10 weeks. Outside of this window, changes are not allowed, except in specific cases.

If your health insurance isn’t cutting it anymore, you can tweak your policy or switch to a new provider. Signing up for a new plan is easy—do it online or over the phone. If you enroll with a new insurer by December 31, they’ll take care of canceling your old policy for you. But if you cancel it yourself by December 31, you’ve got until February 1 to lock in a new plan.

However, there are certain exceptions that allow you to switch health insurance between January 1 and mid-November. These include:

Turning 18: You must take out health insurance within the first month after turning 18.

Moving to the Netherlands: New residents are required to obtain health insurance.

Joining a new employer’s collective bargaining unit: This may allow for a policy change.

Divorce: The policyholder has the right to cancel the health insurance of their partner and children.

How to Cancel Insurance When Leaving the Netherlands

If you decide to cancel your health insurance, you must meet specific requirements. In most cases, you cannot cancel your insurance mid-year unless you meet certain conditions, such as leaving the Netherlands or switching to an international insurer.

You can only cancel your Dutch health insurance in the following situations:

Switching to a New Insurer

If you switch health insurance during the open enrollment period (November 12 – December 31), your new insurer will handle the cancellation for you.

Your current insurance will end on December 31, and your new coverage will begin on January 1.

Moving Abroad (Deregistering from the Netherlands)

If you leave the Netherlands permanently, you must deregister from your municipality (gemeente). After deregistration, you can request a cancellation from your insurer by providing proof of your departure.

No Longer Required to Have Dutch Health Insurance

If you no longer work or live in the Netherlands but remain registered, you may not need Dutch health insurance. Check with the Sociale Verzekeringsbank (SVB) to determine if you qualify for an exemption.

Switching to an International Health Insurance Plan

If you are an expatriate or have international coverage, you may be able to cancel your Dutch health insurance, but you must provide proof of your new insurance.

*Note: Ensure your cancellation request is submitted before December 31 to avoid being charged for the next year.

Final Thoughts

The Dutch healthcare system, while robust and comprehensive, can present a learning curve for newcomers and even long-time residents..

The complex terms alone are enough to make your head spin, and if you’re an expat with little to no understanding of Dutch, the process can feel almost impossible to comprehend. From choosing the right policy to understanding coverage options and deadlines, there’s a lot to take in.

However, when you carefully study the available health insurance plans from different providers, you’ll be on the right track. By using comparison tools, considering deductible options, and checking for zorgtoeslag eligibility, you can find the most cost-effective plan for your needs.

Also, be mindful of annual switching deadlines and cancellation rules to avoid unexpected costs or gaps in coverage. Taking proactive steps to review your insurance options each year can help you save money and access the best healthcare services available in the Netherlands.

FAQ

No, healthcare in the Netherlands is not free for anyone. Everyone, including Dutch citizens, must have at least basic health insurance (basisverzekering). This covers essential medical care like GP visits, hospital stays and some medications.

If you have a low income, the government may help by giving you a healthcare subsidy (zorgtoeslag). You can apply for this through the Dutch Tax Authority (Belastingdienst).

However, children aged 17 and under are included in their parents’ health insurance policies at no additional cost. Parents must still enroll their child in a health insurance plan within four months of birth.

Health insurance is required by law. If you don’t get it within four months of living in the Netherlands, you’ll receive a letter from CAK. This gives you three months to arrange coverage. If you fail to do so, you will receive a fine of €528.

After two fines, the CAK will automatically register you with a health insurer and deduct the premium from your income. It’s best to get insurance as soon as possible to avoid trouble.

Most expats need to switch to a Dutch health insurance provider. You can only keep your foreign insurance if it meets Dutch requirements.

Some exceptions apply, like for students, posted workers and diplomats. If you’re unsure, check with the Sociale Verzekeringsbank (SVB) by doing a Wlz assessment to see if you need Dutch insurance. If your insurance doesn’t qualify, you’ll have to switch.

For expats, once you find a nearby GP, you can visit their website or call them to check if they provide consultations in English.

Another great option is booking online consultations through platforms like Air Doctor or Mobi Doctor, which offer English-speaking doctors and can be very convenient.

Make sure that you register with a GP early, as you’ll need a referral from them to see most specialists.