It is no longer news that coliving market has gained phenomenal traction among young professionals and digital nomads searching for housing options that suit their lifestyles and budgets. The question left is – what is the math behind the population growth and the growing number of real estate developers looking to invest in coliving properties?

European investors are already eyeing coliving with increasing interest. This type of opportunity is perfect for investors looking for financial viability and having a broad spectrum of real estate and investment property portfolios. In the first quarter of 2023, Savills found that 38% of investors are already investing capital in coliving and that 51% plan to target coliving market in the next three years, making it the joint third most invested in ‘Living’ market sector, following multifamily and student housing or Purpose Built Student Accommodation (PBSA).

With this increasing housing market demand, it is important to be informed of the real value of investing capital in coliving. This article looks closely and studies a financial comparison of a 10,000 sqm long stay coliving building versus traditional apartments. Through this, we will understand why coliving schemes thrive to hold an appeal with a growing number of young adult residents and investors keen on redefining the urban context of the housing market landscape.

Key Factors in Determining the Business Case

Before diving into the case study, let’s focus first on the definition of the key parameters.

Gross/Net Area Ratio

The gross/net area ratio in project development measures space efficiency and utilization. It calculates the total (gross) area, including all walls and unusable spaces. It also accounts for the usable (net) area that residents can occupy and utilize, whereas net floor area is equal to the gross floor area minus tare area. Tare areas can include walls, columns, and other areas necessary for the building’s structure but do not contribute to the net usable space.

Programming

Programming is the critical planning phase where developers, often with architects, determine the purpose of development, whether commercial, retail, mixed-use, or residential. For instance, in a residential building, you can also further decide whether the development will be a student accommodation, family home, senior housing, or coliving. In this stage of the planning process, stakeholders establish the project’s purpose and requirements to serve as the foundation for determining the configuration of spaces and their relationships and the needs of future residents. Most importantly, it is best to consider the demand and supply in the city and the zoning plan, set forth by the local market or municipality.

Hard Costs and Soft Costs

Hard costs refer to the capital incurred in physical construction, encompassing materials, equipment, interior finishes, and labor incurred, such as excavation, carpentry, electrical wiring, and plumbing. Soft costs, on the other hand, encompass market research, architectural design fees, legal fees, project management fees, administrative expenses, environmental surveys, and designs. Soft costs are typically strongly correlated to hard costs, meaning that when the project’s hard costs increase, the soft costs usually increase too. This happens because more complex or expensive projects often require more design work, more detailed planning, longer time to get permits, and potentially more legal and management work.

Developer’s Profit

The developer’s profit is the money the developer earns from the sale or lease after all costs have been paid. The required profit varies between developers, but usually, the developer’s profit ranges between 5% to 15% of the project’s total costs. It can be influenced by various factors, including market conditions, location, demand for the developed properties, and the developer’s project management capability.

Financing Costs

Financing cost is a significant factor in determining the project’s feasibility. It is the cost of borrowing or sourcing capital through different financial instruments. In 2023, the general interest rates for properties vary between 4% and 6%. However, considering the higher risk for project developments, an additional risk premium of 200 to 300 basis points (2% – 3%) is typically added to the base interest rate. This means that in the project developments sector, effective interest rates could yield from 6% to 9%.

Gross and Net Rent Yield

In assessing the property’s market value for post-completion investors, gross and net rent yields play a pivotal role.

- Gross Yield: Determined by dividing the annual rental income by the property’s purchase price, then converting that figure into a percentage. This type of yield does not consider operational costs.

- Net Yield: On the contrary, this type of yield incorporates operational costs. It is derived by deducting costs associated with operations, vacancies, and turnover from the annual rental income. This value is then divided by the property’s purchase price to get the percentage.

Investors engage in post-completion property investments as a strategy to offset inflation rates and generate income. These investors often have targeted gross and net yield expectations, which are directly influenced by the risk levels associated with their investments. Understanding these yield requirements is crucial for making informed investment decisions.

Total Annual Basic Rent

One of the most important metrics is the total amount of basic rent all tenants collectively pay for renting the building on an annual basis. It is simply derived from summing up all monthly rents and then multiplying the sum by 12. Basic rent is the most common metric to determine the property’s market value for post-completion investors. While other rent income, such as service costs and utility bills, are part of the property’s operational income, they are not taken into consideration for determining the post-completion property value. This is because the revenue generated from these services are usually similar as the costs associated providing them.

Post-Completion Property Value

In development, the post-completion value is crucial as it determines the success and profitability of a project. It refers to the market value of a property after it has been completed and is fully rented. It is derived by simply dividing the annual total basic rent to the required gross yield. Below is an example of computation.

Annual Total Basic Rent / Required Gross Yield = Property Value

€1,200,000 / 5,0% = €24,000,000

Case Study: 10,000 gross sqm Building

To make this more concrete, let’s take a closer look at a 10,000 gross sqm building in the city of Netherlands and compare a long stay coliving development with a traditional housing development.

Gross/Net Area Ratio

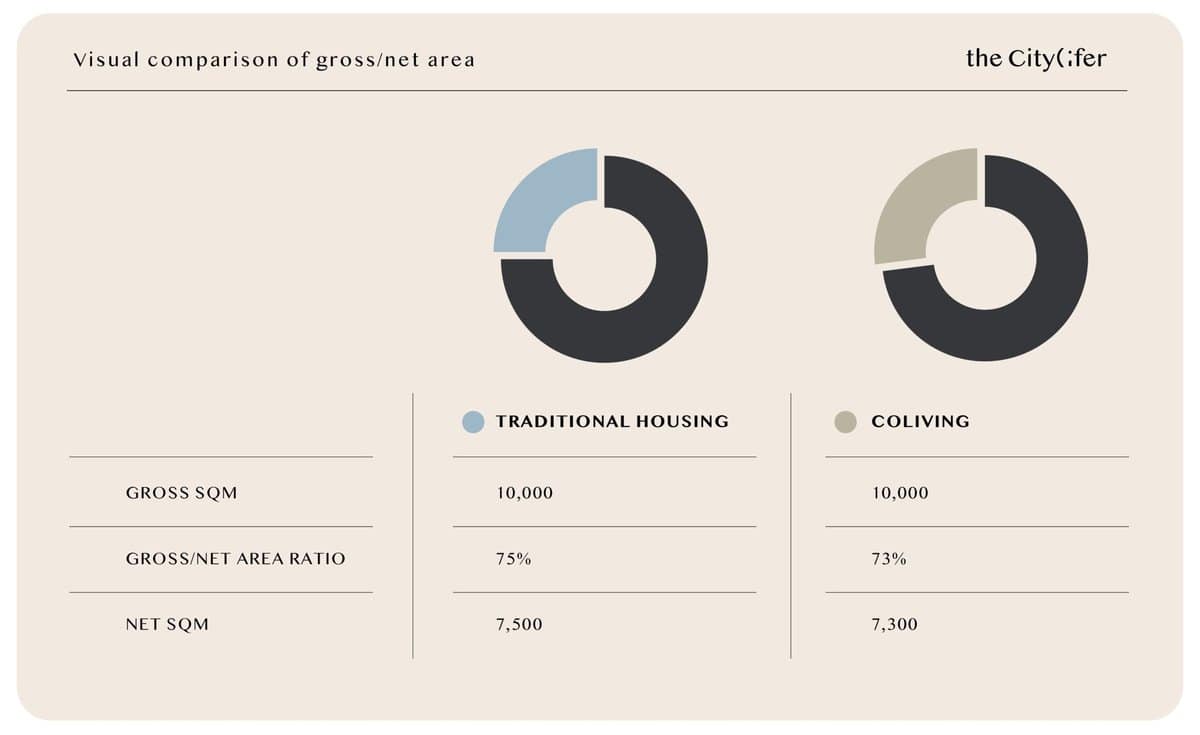

Starting with the gross/net ratio. Typically, a gross net ratio between 65% and 80% is required to make a business case work. In this case study, we will use 75% for traditional housing. For coliving, we’re led to a 2% lower gross net ratio due to the programming differences, more individual units, walls, and infrastructure, resulting in 73%.

“Typically, a gross net ratio between 65% and 80% is required to make a business case work.”

Visual comparison of gross/net area between traditional housing (75%) vs. coliving (73%)

Coliving’s gross/net area ratio may be slightly less favorable, due to more units, walls, and infrastructure, compared to traditional apartments. However, this trade-off is intentional, as it prioritizes more space for individual apartments or bedrooms and shared communal areas, which play a key role in its appeal to residents. On the contrary, the traditional apartments sector offers more individualized living spaces and fewer shared spaces and amenities, resulting in a potentially more favorable gross/net area ratio.

“Coliving prioritizes more space for individual apartments or bedrooms and shared communal areas, which play a key role in its apeal to residents.”

Programming with a Sense of Community Living

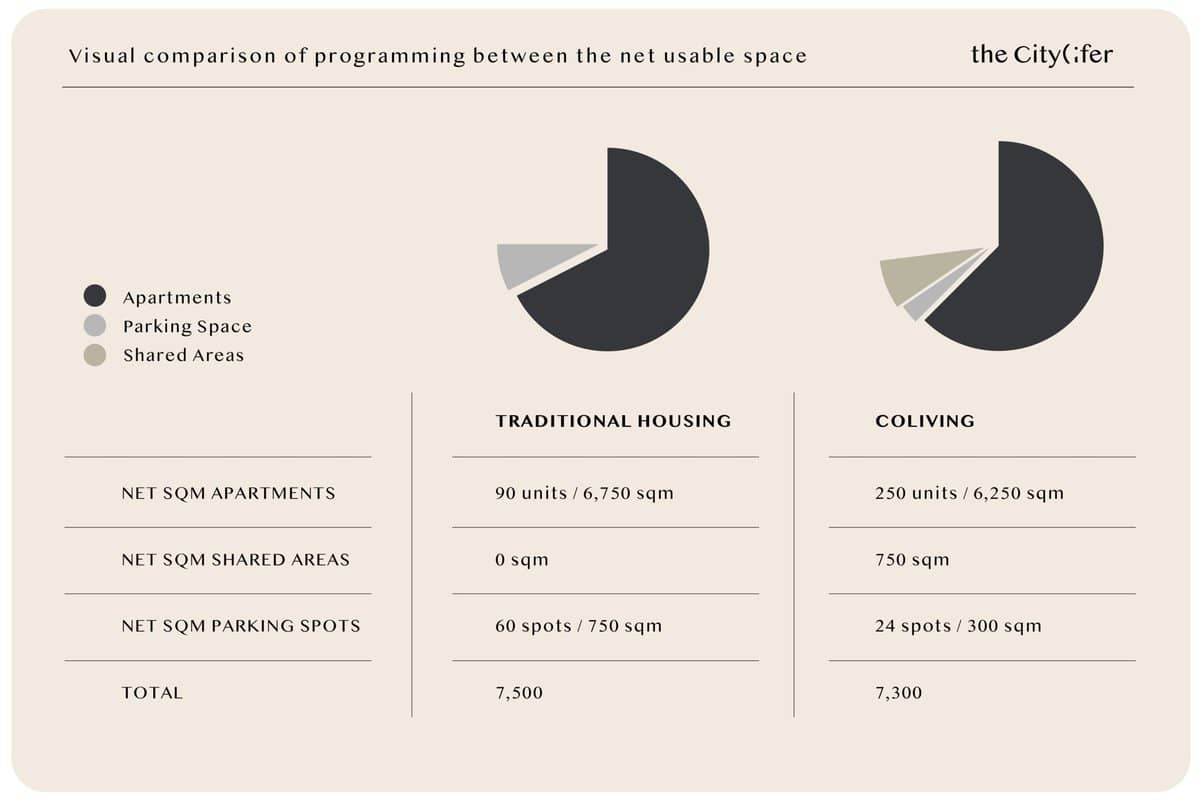

We use the computed 75% and 73% gross/net area ratio in determining the number of apartments that can be created. For coliving, we will use our own studio “The Nomad”, which features a compact and efficient apartment design of 25 sqm, as an example. Coliving’s programming includes shared areas for residents, so we reserved 3 sqm per apartment for shared amenities. Given that the Nomad studio is less than 40 sqm, we calculate a reduced number of parking spots of 0.1 ratios per unit. The net sqm of a parking spot is 12.5 sqm, averaging out to 1.25 sqm per unit.

While for traditional housing, we considered an average apartment size of 75 sqm without any shared areas for its residents. As a result, we calculate 0.65 parking spot ratio per unit, averaging 7.5 sqm per unit.

Visual comparison of programming between the net usable space of traditional housing (90 units) vs. coliving (250 units)

The programming of coliving and traditional apartments varies significantly due to their distinct concepts and target market. Coliving schemes typically have more units since it has smaller private studios, ranging from 20 to 40 sqm. It prioritizes large communal areas, shared amenities, landscaped gardens, and close proximity to public transportation. On the other hand, traditional housing has studio apartments of 40 sqm to multi-bedroom units of 120 sqm, with shared areas limited to hallways and lobbies. Unlike coliving, it prioritizes parking convenience as it usually caters to residents who may have personal cars.

Investment Costs and Developer’s Profit in Coliving Market

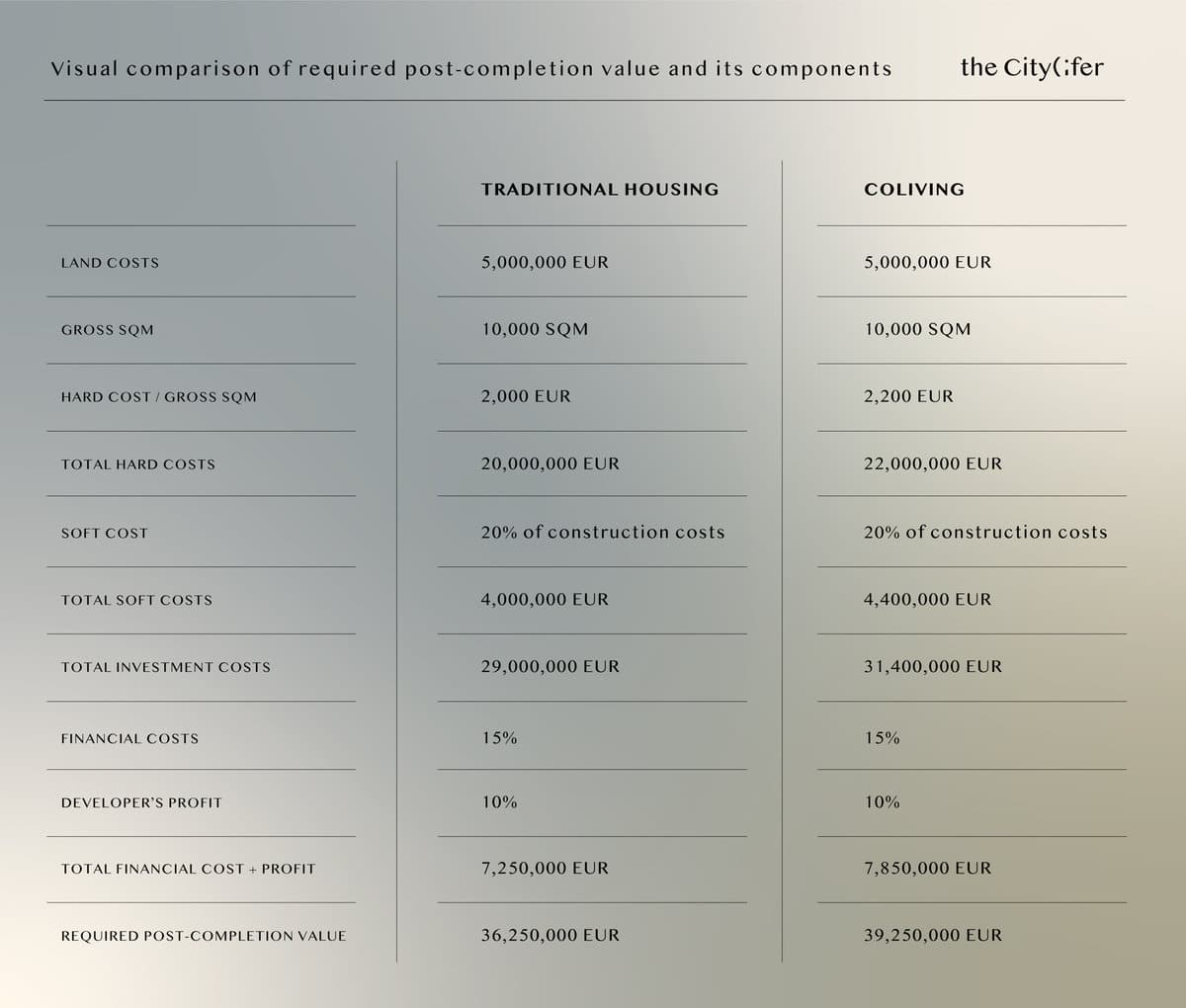

Let’s continue the case study, assuming that the land costs €5,000,000 for both developments and that this project is a newly built construction.

For traditional housing, we will include a unit price of €2,000 ex VAT per gross sqm since it only typically contains apartments and parking spots.

Coliving developments, on the other hand, although have fewer parking spots, produce more units, leading to more bathrooms, kitchens, co working spaces, and installations. The duplication of the design elements and repetition of the studio layouts make it easier for the contractor to build because it requires fewer modifications per floor. In turn, one studio can be built relatively cheaply. Overall, what makes coliving developments slightly more expensive than traditional apartment developments is it has more units to complete. Considering these, we will include an additional €200 ex VAT per gross meter, resulting in a unit price of €2,200 ex VAT per gross sqm.

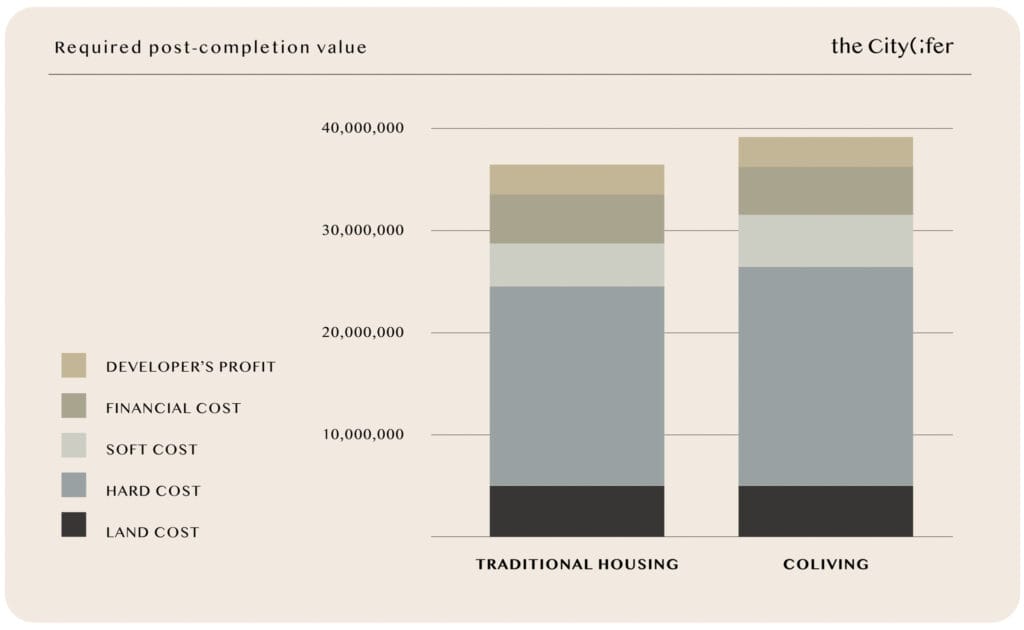

Visual comparison of the required post-completion value and its components, between the traditional housing (€36.25 mil) vs. coliving (€39.25 mil)

For the soft costs, we add 20% for both coliving and traditional housing developments and another 15% for financing cost and 10% as developer’s profit. Hence, to make at least a 10% profit, the developer has to price the property at least at €36.25 million for a traditional housing development and €39.25 million for a coliving development.

Low and Ideal Pricing for Young Professionals

Knowing the required post-completion value, the only question remains how much basic rent should be generated to make it an attractive business case. The required total basic rent can be calculated by:

Post-completion property value x required gross yield

The required gross yield for investors is determined by the risk perception of the specific building. Investor expect and demand higher gross yields from coliving developments compared to traditional developments due to two reasons:

- Higher operational costs due to more intensive management and higher turnover rates

- Coliving is a new concept, which is perceived as riskier, yet premium yields are demanded.

Given the operating nuances and novelty of the concept, investors usually expect a marginally elevated gross yield. This often ranges from 0 to 25 basis points, which is higher than what’s anticipated from traditional housing developments in major cities. In fact, in Q1 of 2023, prime yields in Amsterdam were around 4% and around 5% in Rotterdam. So we will calculate with a gross yield of 5,0% for traditional housing and 5,25% for the coliving development.

The total annual rent required is around 13.7% higher for the coliving development, but if we calculate the price per individual unit you see that it’s a staggering 59% lower than traditional housing.

The total annual rent required is around 13.7% higher for the coliving development, but if we calculate the price per individual unit you see that it’s a staggering 59% lower than traditional housing: €687 for a coliving unit compared to €1.678 for a traditional apartment.

Considering entry-level gross salaries in The Netherlands are around €2.000 per month, the monthly rent of a traditional apartment would eat up a mindblowing 84% of a young adult’s salary. Better said, it’s impossible for young adults to rent a traditional apartment, a phenomenon that is clearly shown in the current housing market. A coliving studio on the other hand costs a young adult around 34% of its salary. This is very close to the 30:40 rule, a guideline that strongly advises low-income households to spend less than 30% of their income on housing. Hence, coliving offers a housing solution that fits the budget and needs of young adults, while it allows investors to make a positive social impact.

Conclusion

Although simplified, this business case study strongly represents the strength of investing in coliving compared to traditional housing. Coliving can solve the huge housing affordability crisis in The Netherlands, within the €600 to €1,000 price range, by allowing more individual units per building and allowing developers to rent the units for much lower prices. The substantial amount of available units at much more accessible rates outweighs the fact that it has a slightly higher upfront cost. Besides being cost-effective, coliving schemes became an ideal solution to the housing sector to meet the growing market demand for community-centric living. These reasons are more than enough to answer our question from the introduction – why is there a growing number of developers eyeing to invest in the coliving sector?

Ultimately, each city and business sector varies and requires special attention. The Citylifer is constantly open to discuss business and look for valuable collaborations. If you have ideas and projects in mind and are interested in such a partnership, do not hesitate to get in touch.

The Citylifer Perspective

The Citylifer strongly believes in the strength of coliving for both residents and developers. It acknowledges how coliving offers residents the opportunity to live in urban areas for a reasonable price, while simultaneously being part of a like-minded community. For developers, we have designed a building that is modular and answers to the needs of young adults and offers a strong operator side.

Modular design to upcycle urban spaces

The Citylifer’s sustainability-focused design is based on an office grid structure. This innovative design allows repurpose vacant inner city office buildings while also accommodating newly constructed development. There are significant benefits of upcycling, such as shorter projected lead times, lower construction costs and reduced environmental impact.

One-stop concept and operator solution

The Citylifer acts as both concept and operator. It means we can be involved in the location scouting and acquisition, the design of the building, and all the way to the operations of the building. This one-stop solution creates a seamless and consistent experience, which also helps in smoother dealings with local authorities involved.

Fair and transparent pricing

Our pricing is compliant with local regulations and ensures transparency for residents. For the Netherlands, this means that basic rent prices are compliant with the WWS point system and service costs are priced by national regulations set forth by Huurcommissie. Moreover, there are no hidden fees for residents. All pricing components are disclosed upfront.

ESG-compliant investment

Driven by a passion for sustainability, social responsibility, and effective governance, The Citylifer has crafted an ESG policy that is intently integrated in all our operations. Our goal is to create a substantial impact, not only for the betterment of the planet but also for the well-being of the people around us. In this collaborative journey, we openly invite residents and neighbors to join hands with us in championing positive change towards a sustainable future.

FAQ

Traditional housing features individual units or homes where tenants have private spaces with limited access to shared amenities while coliving emphasizes community building and social interactions, private bedrooms or units, and full access to shared common areas and community events.

Two advantages of coliving are networking opportunities for tenants and flexible terms, from long short term to long term leases, while the disadvantages are people frequently come and go and the possibility of different lifestyles, housing needs or preferences.

Coliving offers tenants both the benefits of private living spaces and shared facilities to encourage a sense of community living. Apartments, on the other hand, consist of separate individual living units, often without shared amenities, fostering more privacy.

Coliving offers a cost-effective alternative to the scarcity of affordable housing by optimizing space and creating more units at lower costs. It fosters community and modern living, appealing to residents and investors keen on redefining the housing landscape.