Who wouldn’t want to live in a country where you can explore cities on a bike and see picturesque canals on your way to work? Little villages, windmills, a cold Heineken—it’s impossible not to dream of moving to the Netherlands.

But before you pack your bags, there are a few things you might want to consider, particularly the housing market. In cities like Amsterdam, Utrecht and Rotterdam, the housing market has seen high demand and limited supply.

In fact, according to Rabobank, house prices are on the rise. Data suggests that houses are expected to cost 6.2% more than last year, and 6.3% more in 2025. The permitted rent increase in the private sector has also increased to 5.5% until May 1, 2024.

Here’s where understanding the total cost of renting becomes important. On top of rent, you also have to pay for utilities like electricity, water and internet. Not to mention service charges, insurance, taxes, and other expenses like groceries, clothing, and more.

When you factor in all these costs, you’ll get a much clearer picture of your monthly housing budget. You ensure everything doesn’t turn into a budget nightmare.

We’ll explore the Dutch rental market further in the next section, providing a more detailed breakdown of total apartment costs.

Understanding The Dutch Rental Market

Before we discuss the cost of renting an apartment in the Netherlands, we’ll first give you a quick overview of the country’s rental market.

The Dutch rental housing market is split into two categories: the social rental sector and the private rental sector. The deciding factor for which category a home falls into is called the Home Valuation System (WWS). However, the government introduced the Affordable Rent Act, which took effect on July 1, 2024. This new legislation will add a third sector called the mid-rent segment.

The main difference between the mid-rent sector and the social rental sector is:

- The mid-rent sector is designed to cater to middle-income earners who do not qualify for social housing but still find private market rents unaffordable.

- It aims to fill the gap between social housing and higher-cost private rentals.

- There are no strict income caps like those in the social sector.

- Tenants in the mid-rent sector do not typically receive direct housing allowances.

The Social Rental Sector

Social housing in the Netherlands is meant to cater to Dutch citizens with lower incomes. It comes with two key things to remember:

- Income caps: There’s a limit on how much a tenant can earn to qualify for a social rental apartment.

- Financial assistance: If you do qualify and become a tenant in the social rental sector, you might be eligible for a rent allowance, which can further reduce your housing costs.

To apply for social housing, you should register with the right housing association, get a housing permit, and meet eligibility requirements. Keep in mind that different housing associations cater to different regions, so ensure you’re contacting the appropriate one for your area.

While the social sector is attractive due to its affordability, it has some significant drawbacks:

- Availability and Waiting Time: Social housing often has long waiting lists due to high demand and limited availability. It can take several years to secure a social housing unit, especially in major cities like Amsterdam, Rotterdam, and Utrecht.

- Lower Quality: The private rental sector typically offers a wider variety of housing options, including higher quality apartments, better locations, and modern amenities that might not be available in the social sector.

- Variety of Housing: The private rental sector often offers a wider variety of housing options, including furnished options, which can be convenient for tenants who prefer not to buy and move furniture.

- Limited Flexibility: The private rental market often provides short-term lease options, which are rare in the social sector. This flexibility is ideal for expatriates, students, or professionals on temporary assignments.

The Private Rental Sector

In the private sector, rental prices are higher compared to the social rental sector. This means that renting a room, studio, or apartment is more affordable in social housing than in the private, non-subsidized sector.

However, it grants more freedom to both the landlord and the tenant when it comes to rent and provided services. This is because rental contracts are liberalized.

You get more freedom, but with less government protection & benefit:

- No maximum rent: Landlords can set their own asking price, meaning rents can be higher.

- No waiting lists or points system: You don’t have to wait or meet specific criteria to qualify. However, securing an apartment might be more competitive.

- No rent subsidies: Rent allowance programs aren’t available for private rentals.

- Limited tenant protection: The Rent Tribunal (Huurcommissie) can’t mediate ongoing disputes in the private sector. However, theycan assess the fairness of rent prices within the first six months of tenancy.

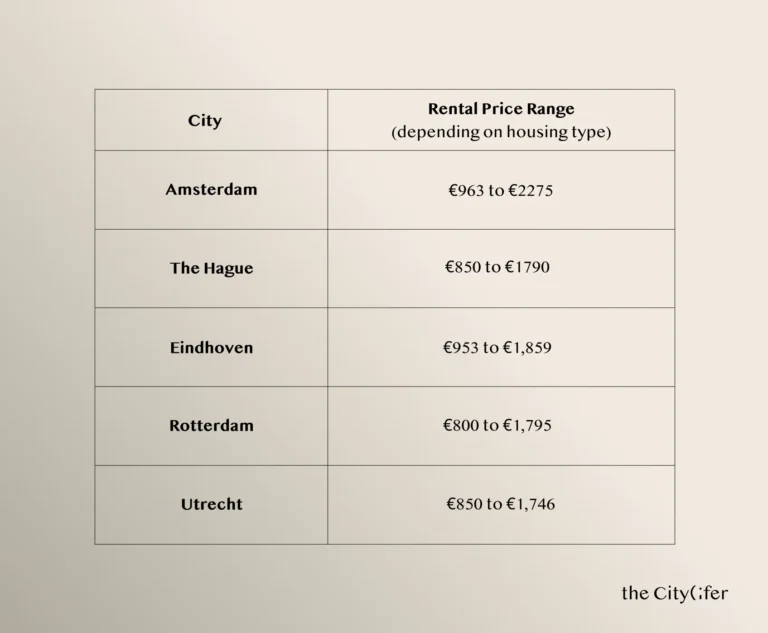

When considering rental options in the Netherlands, you should also consider the rental price ranges in the five largest cities. This includes The Hague, Rotterdam, Amsterdam, Utrecht and Eindhoven.

According to the HousingAnywhere International Rent Index, here are the rent prices in major cities in the first quarter of 2024:

The rental prices in the country’s largest cities also rose in the first quarter of 2023. As reported by the housing platform Pararius, Amsterdam, Hague & Rotterdam saw the biggest jumps (>4%).

Initial Costs of Renting an Apartment

One of the things you have to factor in when renting an apartment in the Netherlands is the initial expenses you might encounter. Unfortunately, you can’t just pay the rent, unpack your bags, and go about your day.

Here are some of the initial costs you need to consider:

Security Deposit Expectations and Legal Limits

While there’s no strict limit on security deposits, landlords can’t ask for an excessive amount. According to the new law Wet goed verhuurderschap (Good Landlordship Act), for rental contracts that start after July 1, 2023, landlords can request a maximum deposit of up to two months of basic rent.

You’ll get your full deposit back when you move out as long as:

- Your rental agreement has ended or you have properly canceled it.

- You haven’t caused any major damage to the property.

- You have respected all terms and conditions of the rental agreement.

Just keep in mind that landlords can deduct unpaid rent from your deposit. They are also not required to pay interest on the deposit.

What If Your Landlord Refuses to Return Your Deposit?

If your landlord doesn’t return your deposit after the agreed deadline, send a registered letter (aangetekende brief) requesting the return. If there is still no response, you may consider seeking legal help.

Remember: Landlords often pay up after receiving a registered demand letter, as court battles are expensive.

First Month’s Rent In Advance

Alongside the security deposit, tenants are often required to pay the first month’s rent in advance. This upfront payment ensures that you’re financially prepared for your first month in the apartment. Make sure to budget accordingly to avoid any last-minute financial strain!

Agency Fees, If Applicable

If you use a real estate agent to find your apartment or go through a website like HousingAnywhere, expect to pay an agency fee. This fee usually equals one month’s rent and is typically paid alongside your first month’s rent and security deposit.

Keep in mind that tenants should only pay brokerage fees to an agent they personally hire to find a property. If the agent works for the landlord, they are already compensated and cannot charge additional fees to the tenant. The only exception is when the agent provides services that directly benefit the tenant and produce clear results, such as creating a name tag for the property.

Key money or fees for drafting the contract or obtaining permits are not allowed. If these fees are applied, tenants can dispute and reclaim them.

Monthly Rental Costs

Finding the perfect apartment in the Netherlands also involves understanding the breakdown of monthly rental costs. Here’s a breakdown to help you budget effectively:

Rent Price Variations

City & Size: Rent prices significantly vary by city and apartment size. Generally, larger apartments and those in major cities demand higher rents.

Furnished vs. Unfurnished: Expect to pay more for furnished apartments, which offer the convenience of move-in-ready furniture and appliances.

Note: Rental prices are subject to change and may vary based on factors like location, amenities, and apartment condition.

Utilities and Service Charges

Bear in mind that when searching for apartments, the advertised rent is not the full cost. It’s important to clarify whether the price is inclusive (combining rent and utilities into one monthly bill) or exclusive (rent only, with utilities added separately).

If the rental price does not include utility costs, you will need to set up utilities such as gas, electricity, water, and internet. To get started, you will need to gather the necessary paperwork, such as a rental contract, a bank statement or proof of residency from your municipality, and proof of identity.

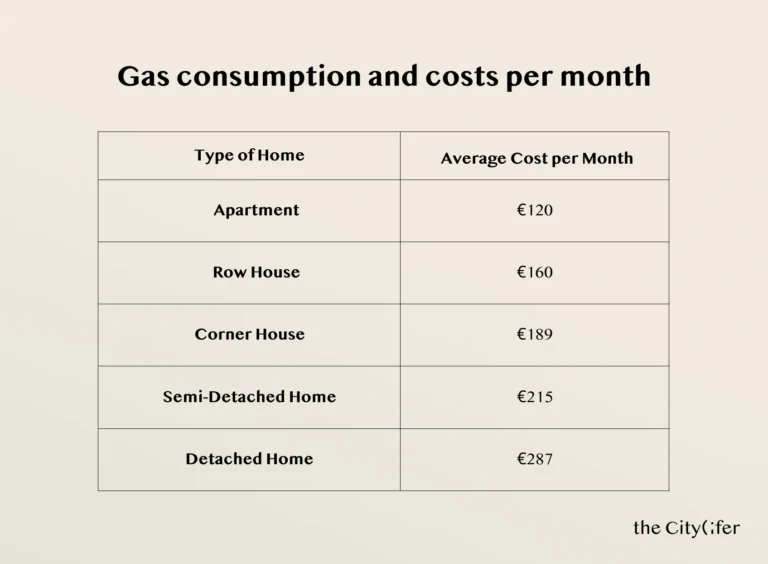

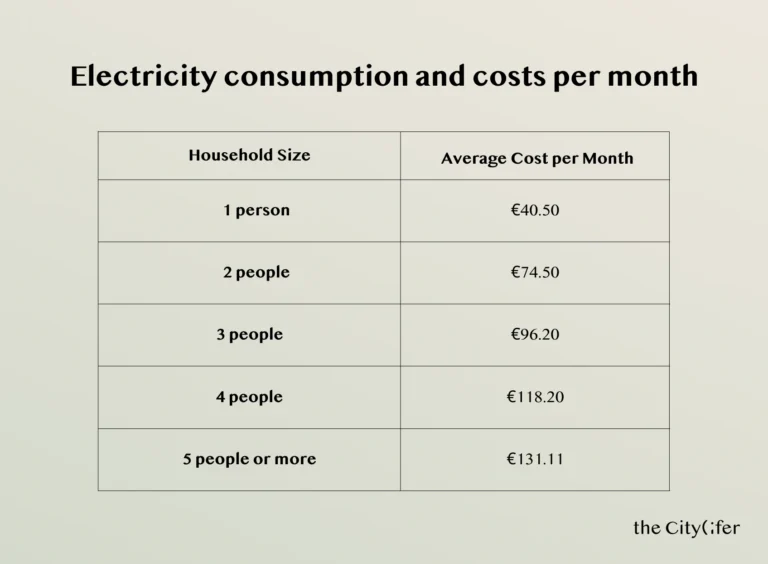

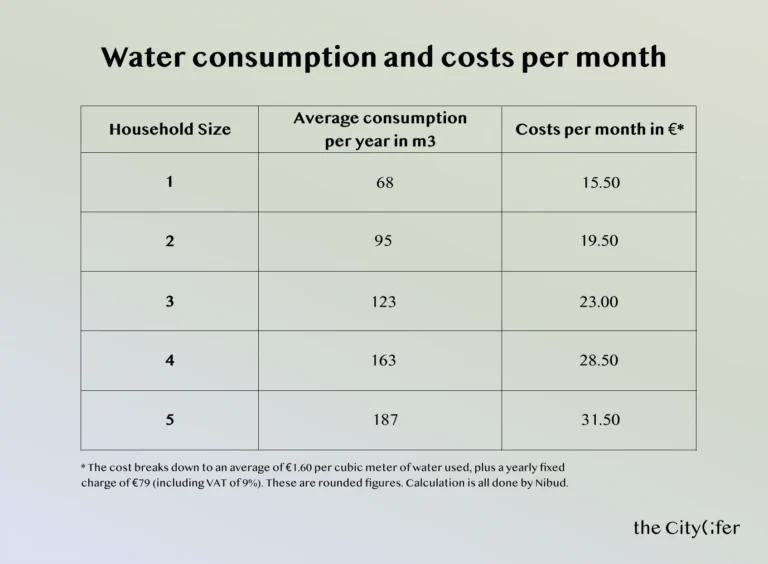

Of course, the average gas, electricity, and water usage—as well as the cost—will depend on the type of house and household size.

Additionally, choosing a utility provider in the Netherlands can be challenging, especially if this is your first time being a tenant.

The good news is that you don’t have to spend a huge chunk of your hard-earned money on utility bills. Here are some tips to help you save on utilities:

- Be mindful of usage. This applies to everything from electricity and water to heating and cooling. Simple steps like turning off lights when not in a room, taking shorter showers and adjusting your thermostat can make a big difference.

- Turn down the heat to 15 degrees at night. This could potentially save you up to €100 annually.

- Don’t be tempted by bundled package deals: This applies to internet plans (like Ziggo, KPN and Odido) but also other services. Many companies offer packages with cable TV, landlines and other features you might not need. You can often save money by choosing an internet-only plan and only paying for what you use.

- Shop around: Don’t be afraid to compare utility providers and plans to see if you can get a better deal.

- Take advantage of energy audits: Some utility companies offer free or discounted energy audits to help you identify areas where you can save energy.

Internet Costs

One of the first things you’ll want to do upon moving in is get connected. Luckily, the Netherlands offers a variety of internet providers, using technologies like cable, ADSL/VDSL, and fiber optics. But your specific internet options can depend on factors such as your location, building age, and the building’s connection points.

To get you started, here are the best internet providers in the Netherlands:

- Ziggo NL

- Budget Alles-in-1

- Odido

- KPN

According to InternetVergelijk, you can expect to pay between €30 and €100 per month for internet service, with costs varying based on the speed and type of connection you choose.

Taxes Related to Renting

Water Board Tax

In addition to rental income tax, both tenants and landlords may be subject to water board tax (waterschapsbelasting). The tax goes towards water management and infrastructure projects. It consists of two parts:

- Purification Levy (Zuiveringsheffing): If you operate commercial premises and release wastewater into the sewer, you’re required to pay a water purification levy.

- Water System Levy (Waterverzorgingsheffing): This levy applies to everyone who owns or uses a property, including residents and property owners.

Municipal Taxes

You will also encounter municipal taxes that can include different charges related to waste collection and sewage services. These taxes are levied by local municipalities and may vary but typically include:

- Sewage Tax (Rioolheffing): If you own or use a property connected to the municipal sewerage system, you might pay a sewage tax to help maintain the city’s sewer system.

- Waste Collection Tax (Afvalstoffenheffing): If your municipality handles your industrial waste and trash collection, you will have to pay a waste collection tax.

- Parking Tax (Parkeerbelasting): Parking tax is only applied when you fail to pay for your parking spot. In such cases, the fine you receive will include the parking tax. You’ll also receive a notice detailing the penalty amount. If you wish to dispute the fine, you’ll need to contact the municipality that issued it. Paid parking fees contribute to the overall parking tax in the Netherlands. To find areas where parking is free, check your local municipality’s website for information on no-pay zones.

Home Insurance Requirements for Renters

If you think taxes and rental costs are the only financial burdens of being a tenant, think again! While not mandatory by law, having home insurance in the Netherlands is highly recommended for tenants. It can safeguard you against unforeseen events like flooding, break-ins, or household accidents, to name a few.

The basic coverage of home insurance usually includes fire, storm, water damage, theft, and vandalism. You can often add other options like earthquake insurance or coverage for accidentally leaving the faucet on (or forgetting to lock the door!). However, don’t expect it to cover things you do on purpose or the natural wear and tear of living.

Think of home insurance as a safety net for your belongings: furniture, clothes, electronics, and even carpets in most cases. If you have expensive art, jewelry, outdoor belongings, or anything you take with you frequently, you might need more or separate coverage. It won’t protect things permanently attached to the building, like windows or built-in cabinets.

Take a look at some of the best home insurance companies in the Netherlands:

Understanding Rental Agreements

Not everything about renting will involve money. Sure, rent is a big part of the equation, but there’s more to a smooth experience than just the monthly payment, bills, and taxes.

When you become a tenant, you should be responsible for understanding the rental agreement. You can’t just sign on the dotted line without knowing what you’re agreeing to. A rental agreement isn’t just a piece of paper; it’s a legal contract that outlines the terms and conditions of your tenancy. It’s your roadmap for living in the property and interacting with your landlord.

Here are the following details a Dutch rental agreement commonly includes:

- You and your landlord’s details and signatures

- Monthly rent, payment method and any security deposit

- Address and description of the property

- Start and end dates of the tenancy

- House rules (pets, guests, smoking etc.)

- Additional costs like utilities (water, gas, electricity, internet and phone)

- Responsibilities for repairs and maintenance for both landlord and tenant

- Notice period for ending the lease for both landlord and tenant

- Inventory list (if furnished)

- Annual rent increase date

Sometimes, circumstances may also change, and you might need adjustments to your living situation. This is where you might encounter contract change and a new tenancy agreement. As a tenant, it’s important to know their key differences, including:

- Contract terms

- Check-in procedures

- Check-Out Procedures and Settlements

- Administrative Costs

Tenant Rights and Responsibilities

Living in the Netherlands as a tenant comes with a good balance of rights and responsibilities. Here’s a breakdown:

Understanding Your Rights

- Maintenance, Privacy and Rent Adjustment: Your landlord is responsible for ensuring the property is habitable and fit for purpose. This includes major repairs, maintaining a peaceful living environment and following proper procedures for rent increases.

- Security of Tenure: Eviction is difficult for landlords in the Netherlands. You generally have strong protection against eviction unless you violate the terms of the rental agreement.

Responsibilities to Remember

- Noise Regulations: Be mindful of noise levels, especially during nighttime hours. Respect the peace of your neighbours.

- Maintenance: While the landlord handles major repairs, the Dutch Minor Repair Decree outlines your responsibility for minor repairs and upkeep of the property.

- Reporting Issues: Always inform your landlord promptly about any problems or defects in the property.

Communication and Notification Obligations

- Maintenance Issues: Timely communication is key. Inform your landlord about any maintenance issues as soon as they arise. This allows them to address the problem efficiently and minimise disruption.

- Contract Termination: Carefully review the notice period outlined in your rental agreement. Both you and your landlord are obligated to provide the proper notice when terminating the tenancy.

Legal and Ethical Obligations

- Reporting Defects and Disturbances: By law, you are obligated to report any defects in the property to your landlord. Additionally, it’s ethically responsible to report any disturbances that may be affecting your neighbours or the overall living environment.

Additional Living Expenses

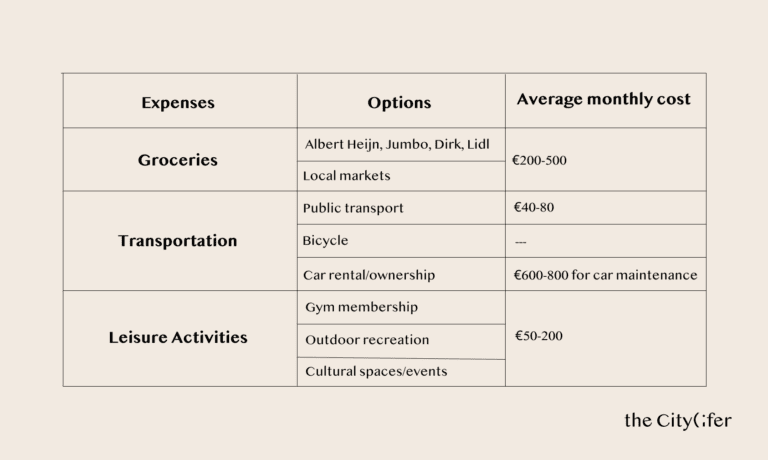

Having a roof overhead is a great first step! To build a secure foundation for yourself, consider adding groceries, clothing and personal care items to your budget.

While this list of expenses might seem overwhelming at first, there’s good news: you can save on many of these costs. Here are some tips for saving on additional living expenses:

- Plan your meals, use grocery store discounts, and explore budget-friendly options like store-brand products and farmers’ markets.

- Consider buying a used bicycle or taking advantage of student discounts on public transport passes.

- Take advantage of free cultural events, explore the Netherlands’ parks and nature trails or enjoy social gatherings at home with friends. Look for discounts and special offers on movies, concerts or other entertainment options.

Whatever you do, spend within your means!

Conclusion

It’s not surprising that the Netherlands has consistently ranked as one of the happiest countries in the world. It has a great healthcare system, good work-life balance, reliable public transportation, and a rich art history, among many others.

But like anywhere, it has its downsides, particularly when it comes to finding an apartment. The rental housing market isn’t exactly promising, with high demand and limited supply pushing rents upwards, especially in popular cities.

Don’t be discouraged! When you know the ins and outs of apartment rental costs in the country, you’re off to a great start. By understanding the different sectors, initial costs, ongoing expenses, and rental agreements, you can make informed decisions and budget effectively.

Careful planning and a little resourcefulness can go a long way. Do your research, stay in the loop with rental housing trends, and monitor new laws. You also need to stay updated on changes in government regulations that might impact rental prices or tenant rights.

In no time, you’ll be settling into your new Dutch life!

FAQ

What is the difference between social housing and private rental housing in the Netherlands?

Social housing offers lower rents but has income caps and requires meeting eligibility requirements. Private rental housing has higher rents but offers more freedom in terms of rent prices and services provided.

How much does it cost to rent an apartment in the Netherlands?

Rental prices vary depending on city size, apartment size, furnished or unfurnished status, and other factors. For instance, renting a place in Amsterdam would cost around €963 to €2,275, depending on the housing type. The Hague, on the other hand, has a rental price range of €850 to €1,790.

What factors should be considered when renting an apartment in the Netherlands?

Here are some key factors to consider when renting an apartment in the Netherlands:

- Social vs. Private housing

- Initial costs, monthly costs and additional living expenses

- Taxes related to renting

- Home insurance

- Legal considerations like rental agreements